Quick Read

- The 10-year Treasury yield dipped as investors anticipate Fed rate cuts and economic signals for 2026.

- Mortgage rates track longer-term Treasury yields, not just short-term Fed policy.

- Experts say inflation and labor market trends will be key drivers of Treasury yields and borrowing costs next year.

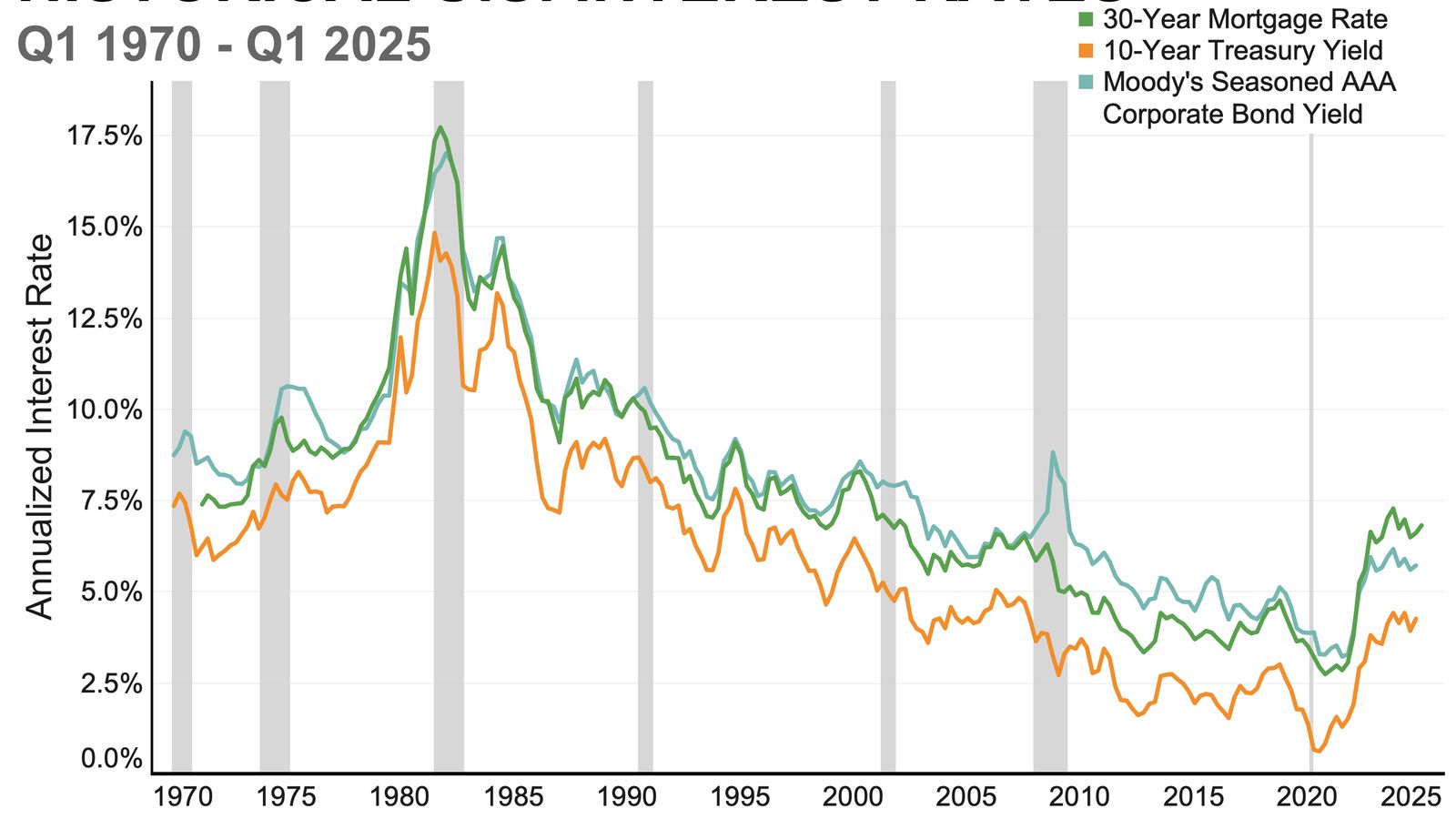

As 2025 draws to a close, the 10-year Treasury yield has become a focal point for investors, homebuyers, and policymakers alike. The yield—essentially the interest rate the U.S. government pays to borrow money for ten years—is more than just a number on a chart. It’s a bellwether for economic confidence, inflation expectations, and the future cost of borrowing across the economy.

Recently, the yield on the 10-year U.S. Treasury dipped, reflecting investor anticipation about the Federal Reserve’s next moves and the broader interest rate outlook for 2026. According to CBS News, the Fed completed its third quarter-point rate cut of the year in December. These cuts, though welcome news for many borrowers, don’t automatically translate into lower mortgage rates. The story is far more nuanced.

Mortgage rates are often thought to move in lockstep with the Fed’s decisions, but experts caution that this is a misconception. While the Fed directly influences short-term rates, mortgage rates are instead tethered to longer-term Treasury yields—especially the 10-year. Why? Because these yields encapsulate investor forecasts about inflation, economic growth, and risk over the coming decade.

Ali Wolf, chief economist at NewHomeSource, notes, “Mortgage interest rates went down before the Fed cut rates in September but went up after. This is because the Fed is cutting the federal funds rate, which is a short-term interest rate. Mortgage interest rates, on the other hand, are influenced by investors and the yield on the 10-year Treasury.” Daryl Fairweather, Redfin’s chief economist, adds, “The Fed controls short-term interest rates, but mortgage rates are more about how the market expects rates to change over the long term.” In short: inflation and the labor market loom large in the minds of bond investors.

This interplay of forces means that the 10-year Treasury yield is a kind of economic weather vane. If inflation continues to cool—as has been seen in recent months—bond markets may price in lower yields. That, in turn, could support lower mortgage rates, perhaps drifting toward the high-5% to low-6% range for a typical 30-year fixed-rate home loan. But if inflation persists, or the economy shows unexpected strength, those yields (and mortgage rates) could remain elevated or even rise.

Dr. Selma Hepp of Cotality points out that, “If inflation continues to cool, bond markets may price in lower yields, helping mortgage rates fall.” Labor market conditions are also critical. A robust jobs market can put upward pressure on wages and prices; a slowdown might give the Fed more room to cut rates further, making borrowing cheaper.

But the story is not just about the U.S. In Canada, the 10-year government bond yield hovers around 3.4%, just below the August high of 3.47%. According to TradingView, this is due to slower economic growth, Bank of Canada’s cautious stance, and softening global rate expectations. The Canadian experience mirrors the U.S. situation, with investors broadly expecting rate cuts in 2026, but central banks remaining wary about the pace and timing of those cuts.

So what does this mean for potential homebuyers or anyone concerned about borrowing costs? Danielle Hale, chief economist at Realtor.com, says, “The Fed sets a short-term benchmark, but mortgages are longer-term rates affected by investor risk appetite and economic expectations.” Even if the Fed continues to ease policy, mortgage rates could remain stable—unless there’s a significant shift in inflation or growth.

Housing supply constraints add another layer of complexity. Many homeowners are still locked into ultra-low mortgage rates from 2020 and 2021, making them reluctant to sell. Ali Wolf estimates that a drop in rates from 6.5% to 6.0% could allow “2 million more households across the country” to afford a home, but cautions that if lower rates are driven by a weakening labor market, buyers may hesitate to make major investments.

As for predictions, there’s a consensus among experts: it’s better to focus on what you can control—like personal affordability—rather than trying to time the market. Mortgage rates could stabilize near current levels (around 6.3% for a 30-year fixed), but shifts in inflation, labor market strength, or global growth could quickly change the landscape.

Ultimately, the 10-year Treasury yield sits at the crossroads of monetary policy, market psychology, and economic fundamentals. It’s both a reflection of where we are and a hint of where we might be going. Investors, homebuyers, and policymakers would do well to keep a close eye on this unassuming number, because in 2026, its movements could shape countless decisions.

Analysis: The 10-year Treasury yield’s subtle but profound influence on mortgage rates and borrowing costs reveals how interconnected global economies have become. While central banks can nudge markets, the real story is written by inflation, labor market dynamics, and investor sentiment. In 2026, flexibility and vigilance will be crucial for borrowers and investors alike, as even small changes in yields may ripple through the financial system, impacting affordability and economic growth. Sources: CBS News, TradingView.