Quick Read

- Private companies own 36% of Aker BP shares, institutions 28%, and the general public 20%.

- Three major investors control 51% of Aker BP, with The Resource Group TRG AS holding 21%.

- London’s FTSE 100 hit a record 10,000 points in early 2026, reflecting strong market confidence.

When investors look at BP’s share price in 2026, they see more than just a number on a screen—they see a story of who truly pulls the strings behind the scenes. At the heart of this narrative is Aker BP ASA, a key player in Norway’s oil and gas sector, whose share price dynamics are closely tied to its ownership structure and the broader market sentiment.

Private companies hold the largest single stake in Aker BP, accounting for 36% of shares. This is not just a statistic; it means private entities wield significant influence, shaping management and governance decisions in ways that can affect every shareholder. Institutions—typically seen as the professional backbone of any major stock—own 28%. Their presence signals confidence but also brings the risk of ‘crowded trades,’ where multiple big players might rush to sell if the winds change. The general public is not left out, holding a notable 20%, giving everyday investors a real voice, even if not the final say.

The top three investors collectively command 51% of the company, a majority that can tip the scales on key votes and strategic directions. The largest among them, The Resource Group TRG AS, holds 21%. This concentration suggests that a handful of stakeholders can heavily influence Aker BP’s trajectory—whether that means steady growth, bold expansion, or cautious consolidation.

Insiders, including board members and top management, own less than 1% directly. While this might seem low, it’s typical for large, publicly traded companies. However, indirect interests via private companies can muddy the waters. Insider ownership often signals alignment with shareholders, but too much concentration can sometimes limit broader accountability.

Meanwhile, public companies own around 16%, hinting at strategic partnerships or entwined business interests. In today’s energy landscape, such stakes can lead to alliances that shape everything from operational priorities to long-term investments.

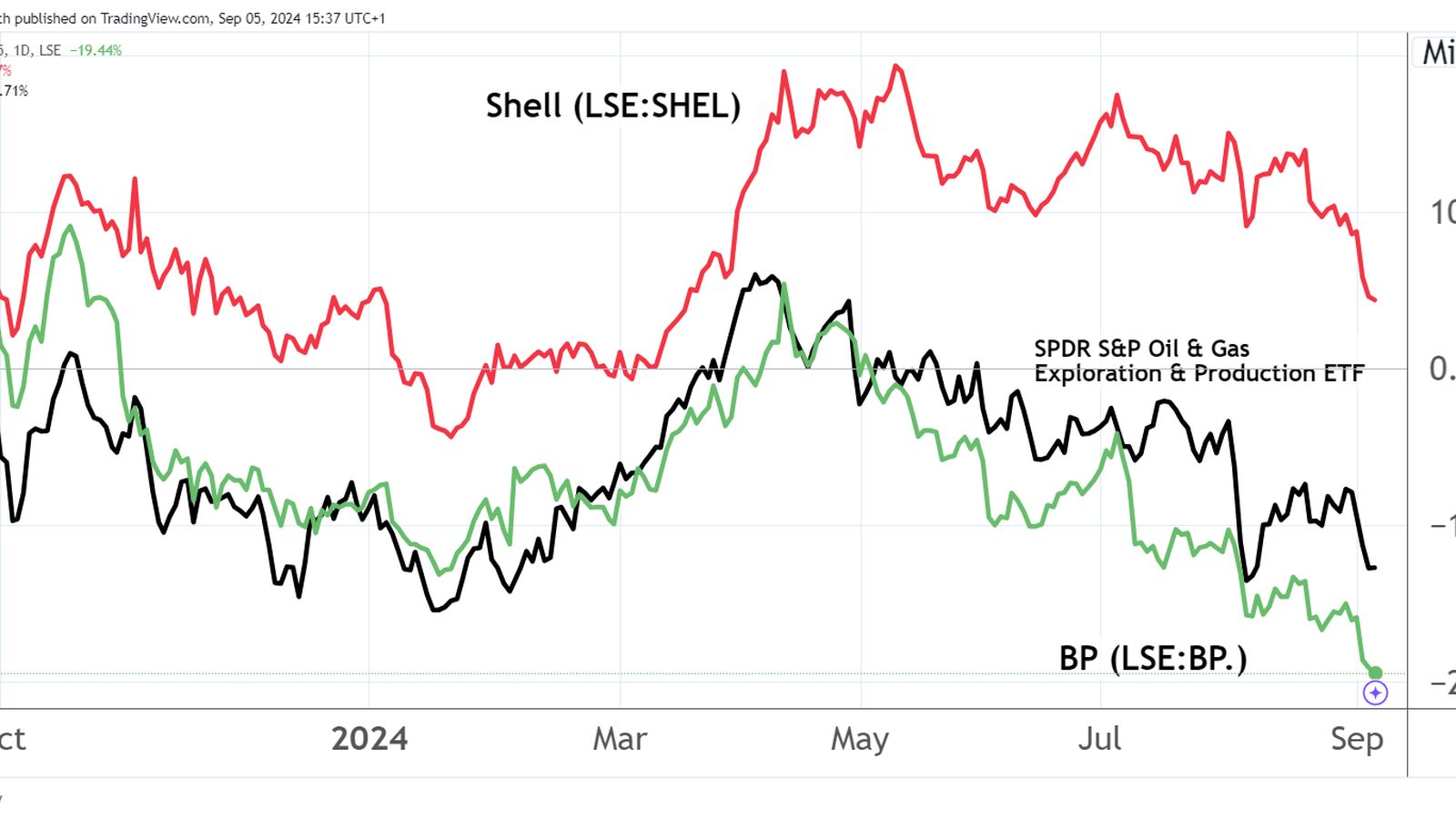

Zooming out, the context for BP’s share price is the broader global market, which entered 2026 on a high note. London’s FTSE 100, home to BP among other giants, broke the 10,000-point barrier for the first time, driven by interest rate cuts in the UK and US and a retreat in global inflation. This surge wasn’t limited to BP; the whole index rose over 21% in 2025, the biggest leap in sixteen years, suggesting robust investor confidence across sectors.

What does this mean for BP and its shareholders? The interplay between private control, institutional investment, and general public participation creates a delicate balance. When institutional investors crowd into a stock, the risk of rapid sell-offs increases if sentiment sours. Private companies, on the other hand, might pursue longer-term strategies, potentially buffering volatility—but also concentrating power. The general public, though holding a smaller stake, can influence company culture and priorities, especially when mobilized around key issues.

For those tracking Aker BP, it’s crucial to keep an eye not just on price charts but on the shifting sands of ownership. Recent insider purchases hint at some internal optimism, but analysts warn of three notable risks in the investment analysis—one of which is particularly significant. As always, forecasts and long-term trends should be balanced with an understanding of market dynamics and ownership structure.

Across the Atlantic, the mood in London’s markets sets the tone for energy stocks like BP. The FTSE’s rise reflects optimism but also underscores the importance of macroeconomic factors—interest rates, inflation, and global demand. When gold miners like Fresnillo can rocket over 400% in a year, it’s clear that investors are chasing momentum, but also recalibrating portfolios in response to shifting fundamentals.

Ultimately, BP’s share price in 2026 is shaped by a tug-of-war between concentrated ownership and market forces. The company’s position on the Norwegian Continental Shelf, its balance sheet, and its investor base make it a focal point for those betting on the future of energy. Whether you’re a major stakeholder or a retail investor, understanding who holds the power—and how they might use it—remains key to navigating the risks and opportunities ahead.

In the current climate, the dominance of a few large shareholders in Aker BP signals stability but also raises questions about agility and responsiveness. With markets hitting historic highs and institutional sentiment running strong, the real challenge for BP may be balancing concentrated control with the need for adaptability in a fast-changing energy world. As always, informed investors should look beyond the headlines and dig into the ownership details to assess both risk and potential reward.

Sources: Simply Wall St, Free Malaysia Today