Quick Read

- Nasdaq Index (^NDX) surged 2.20% on December 15, 2025, closing at 25,196.73.

- Tech stocks, especially Apple and Microsoft, drove an 8.86% three-month rise and 27.67% six-month growth.

- AI-related stocks faced renewed volatility, with Broadcom and Oracle declining sharply.

- Regulatory risks around data privacy and tech monopolies could affect future tech valuations.

- Investors are advised to diversify and use technical indicators like RSI and MACD to manage risk.

Nasdaq Index Surges: Tech Stocks Lead a Market Comeback

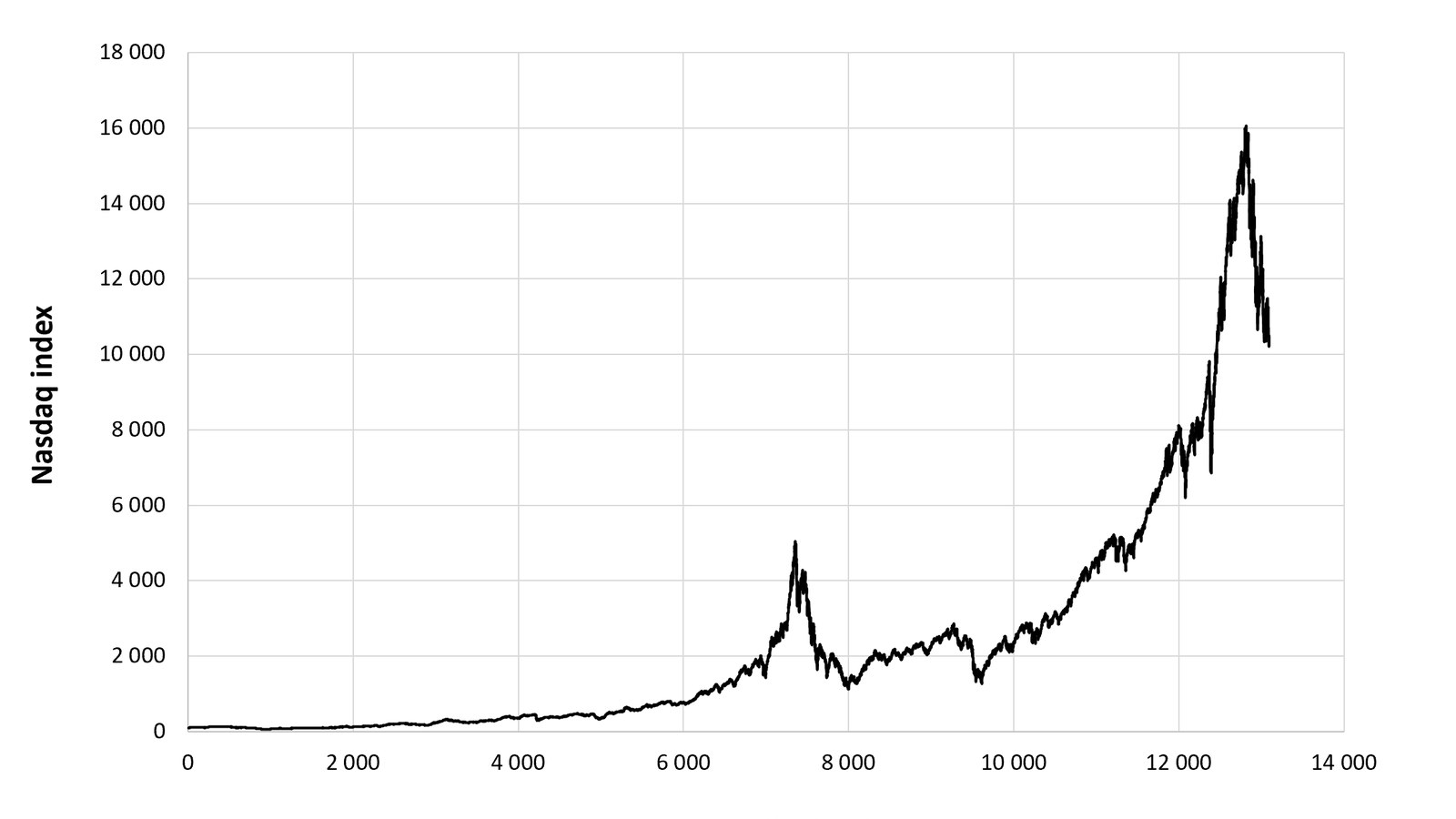

On December 15, 2025, the Nasdaq Index (^NDX) delivered a powerful rebound, closing at 25,196.73, up 2.20% in just one day. The headline might suggest another routine rally, but beneath the surface lies a story of shifting investor sentiment, technological innovation, and the ever-present undercurrent of market volatility. According to Meyka, tech stocks were the primary drivers, registering an impressive 8.86% growth over the past three months, with Apple and Microsoft at the forefront of the surge.

What’s fueling this optimism? Investor confidence in technology is surging again, thanks to rapid advancements in artificial intelligence (AI) and related sectors. Yet, the landscape remains volatile. The Nasdaq’s Average True Range (ATR) sits at 393.37, signaling that sharp moves—both up and down—are likely to persist. For investors, this rally brings opportunity, but it also demands vigilance.

AI Sector Volatility: Opportunities and Caution

The tech rebound has not been without turbulence. While giants like Apple and Microsoft have thrived, other prominent AI-related stocks faced renewed pressure. As CNBC reported, shares of Broadcom and Oracle fell more than 5% and 2%, respectively, contributing to a 0.6% drop in the Nasdaq Composite. The S&P 500 tech sector declined 2.3% over the prior week, reflecting broader uncertainty about the sustainability of the AI-fueled rally.

David Wagner, Aptus Capital Advisors’ head of equities, notes that “everyone hates the AI trade right now,” but maintains that market leadership will remain concentrated in the so-called Magnificent Seven—tech titans with outsized operating leverage. For now, pullbacks are seen as healthy, with Wagner forecasting more gains ahead unless fundamentals shift dramatically.

This volatility underscores the need for a balanced approach. Investors are increasingly diversifying into sectors like healthcare and industrials, which are less exposed to tech’s cyclical swings. Healthcare, in particular, saw heightened interest as the market rotated away from underperforming AI stocks.

Regulatory Risks and Strategic Diversification

The market’s current trajectory is not immune to outside forces. Regulatory scrutiny is mounting, especially around data privacy and tech monopolies—a trend particularly relevant in Canada, where tech investments are becoming central to the economy. New regulations could impact valuations and growth prospects for leading tech companies, making it essential for investors to stay informed about legislative developments.

Canadian investors, and those globally, are advised to diversify portfolios beyond tech stocks. The rally’s promise is real, but so are the risks. Using technical indicators such as the Relative Strength Index (RSI), currently at 47.74, and the Moving Average Convergence Divergence (MACD), can help guide decisions. These tools provide a way to gauge market momentum and spot potential reversals, helping investors balance enthusiasm with caution.

Economic Data and the Road Ahead

The next chapter for the Nasdaq—and for global markets—will be shaped by incoming economic data. The release of November nonfarm payrolls and October retail sales, delayed by the autumn U.S. government shutdown, could set the tone for the coming weeks. Economists anticipate a significant slowdown in job growth, with just 40,000 new jobs expected for November, compared to 119,000 in September. Inflation metrics, notably the consumer price index, are also due, adding another layer of complexity to market forecasts.

These reports will help investors assess whether the current rally is built on solid ground or if further corrections lie ahead. The interplay of tech innovation, regulatory developments, and macroeconomic signals will determine the sustainability of the Nasdaq’s momentum.

Investor Strategies: Balancing Optimism and Risk

So, how should investors respond to this evolving landscape? The recent Nasdaq rally offers a window into both the promise and the perils of concentrated tech bets. Strategic diversification—exploring sectors like healthcare, renewable energy, and consumer discretionary—can help cushion against volatility.

Staying flexible is crucial. Technical analysis should inform but not dictate every move. The blend of optimism and caution is the hallmark of successful navigation in today’s market. As tech stocks continue to lead, the lessons of recent AI volatility remind us that momentum can shift quickly.

Platforms like X (formerly Twitter) are buzzing with investor sentiment, providing real-time insights into market trends. But as always, following the crowd isn’t enough. Investors must combine data-driven analysis with a clear-eyed view of risk, especially as regulatory and economic headwinds may emerge.

In conclusion, the Nasdaq’s December rebound showcases both the dynamism and unpredictability of modern markets. Tech stocks remain the engine, but regulatory and economic uncertainties loom large. For investors, the challenge is to harness the upside while preparing for sudden shifts—a balancing act that will define the months ahead.