Quick Read

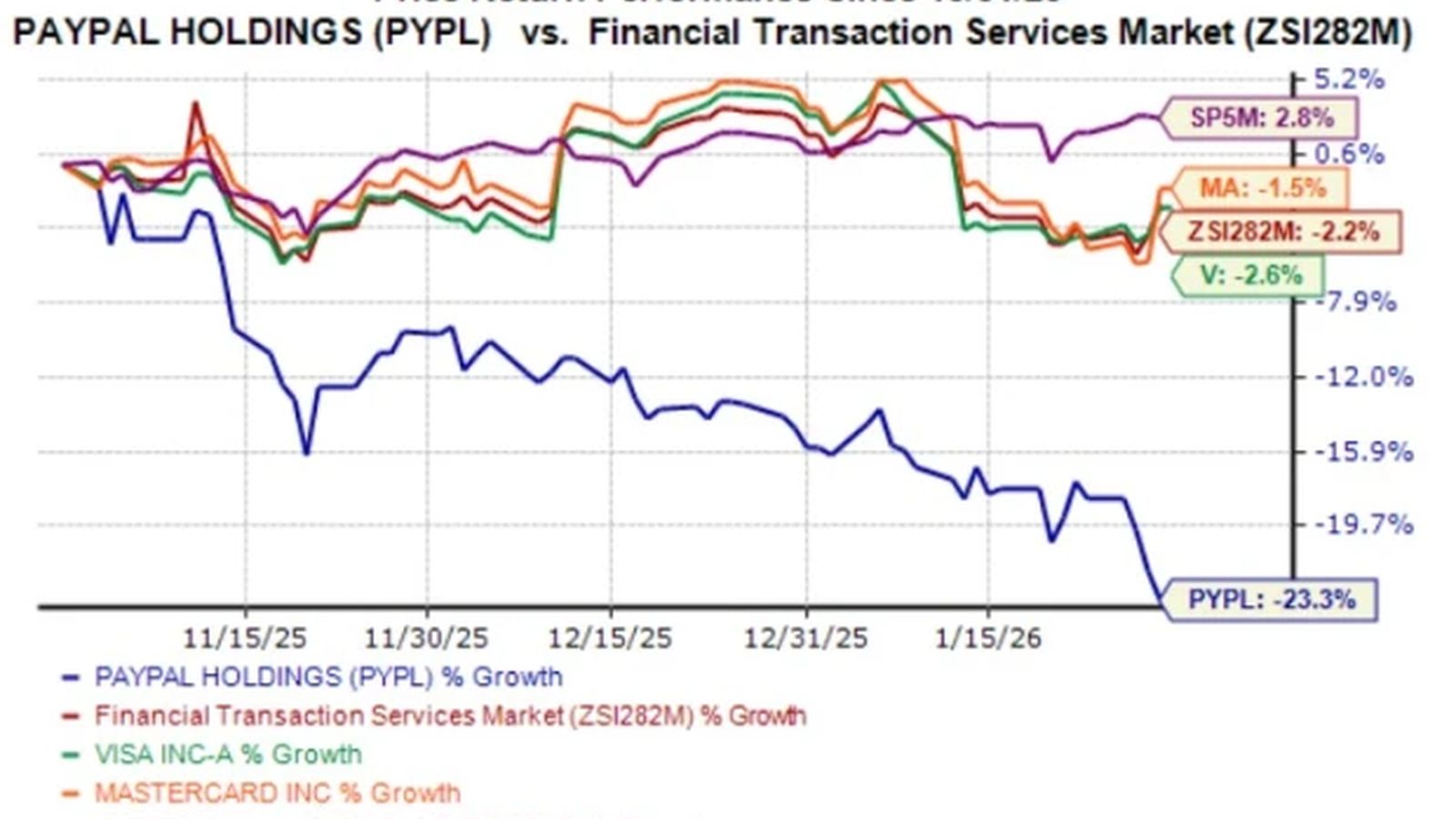

- PayPal’s shares dropped over 17% in premarket trading after weak Q4 2025 earnings and a disappointing 2026 profit forecast.

- The company reported Q4 2025 revenue of $8.68 billion and adjusted EPS of $1.23, both below Wall Street estimates.

- PayPal expects 2026 adjusted profit to decline or show slight growth, contrasting with analysts’ 8% growth expectation.

- HP’s Enrique Lores has been named the new President and CEO, effective March 1, 2026, replacing Alex Chriss.

- Online branded checkout growth decelerated to 1% in Q4 2025, down from 6% a year prior.

NEW YORK (Azat TV) – PayPal Holdings Inc. saw its shares plummet over 17% in premarket trading on Tuesday after the digital payments giant reported fourth-quarter earnings for 2025 that fell short of Wall Street expectations and issued a disappointing profit forecast for 2026. The financial results were coupled with the announcement that HP’s Enrique Lores will take over as president and Chief Executive Officer, replacing Alex Chriss.

The significant stock drop reflected investor concern over PayPal’s projected full-year adjusted profit, which is expected to decline in the low-single-digit percentage or increase only slightly. This outlook stands in stark contrast to Wall Street’s consensus expectation of approximately 8% growth, according to data compiled by LSEG. The company’s board indicated that the pace of change and execution under outgoing CEO Alex Chriss did not align with its expectations, leading to the leadership transition.

Leadership Transition at PayPal

The appointment of Enrique Lores, who served as president and CEO of consumer electronics giant HP for over six years, marks a pivotal moment for PayPal. Lores is slated to assume his new role on March 1, 2026. In the interim, Chief Financial Officer Jamie Miller will serve as CEO. The decision to replace Chriss comes as PayPal navigates a challenging landscape characterized by declining post-pandemic trading volumes and intensified competition.

Alex Chriss had been tasked with steering PayPal through this period, focusing on strategies to enhance profitability. However, the board’s decision underscores the urgency for a new direction as the company faces pressures from both established technology companies and emerging fintech rivals in its core business segments.

Q4 Performance Misses Expectations

For the holiday quarter ended December 31, 2025, PayPal reported revenue of $8.68 billion, missing analysts’ estimates which ranged from $8.78 billion to $8.80 billion. Adjusted profit for the period was $1.23 per share, also falling below analysts’ views of $1.28 to $1.29 per share. Total payment volumes (TPV) showed a 6% rise on an FX-neutral basis, reaching $475.1 billion, as detailed by CNBC and Yahoo Finance.

These fourth-quarter results are particularly notable as they contrast with typical holiday spending trends, where payments firms usually benefit from increased consumer expenditure on gifts, travel, and seasonal promotions. The underperformance highlights the broader challenges PayPal is facing in maintaining its growth trajectory.

Challenges in Branded Checkout and Competition

A key focus for PayPal, particularly under Chriss’s leadership, has been to grow its higher-margin branded checkout business while streamlining costs associated with unbranded processing. However, growth in online branded checkout decelerated significantly to just 1% in the fourth quarter, a sharp decline from 6% a year earlier. The company attributed this slowdown to weakness in U.S. retail, international headwinds, and tougher year-over-year comparisons.

Investors have long expressed concerns about the increasing entry of Big Tech companies, such as Apple and Google, into PayPal’s core payments market. Despite PayPal’s status as a legacy market leader, these competitive pressures have weighed on its stock in recent years. The company stated it is taking near-term actions to restore momentum in its online branded checkout services to address these concerns.

Navigating Broader Economic Headwinds

The challenges faced by PayPal are compounded by broader economic trends impacting consumer spending. Retail spending has softened as shoppers contend with elevated interest rates, stubbornly high living costs, and early signs of a softening labor market. Households are increasingly cutting back on discretionary purchases and prioritizing necessities, a pattern observed across major retailers and consumer goods companies. This environment creates a difficult backdrop for payments companies like PayPal, which rely on robust consumer spending for growth.

The strategic shift in leadership, combined with a cautious financial outlook and intensifying market competition, signals a critical period for PayPal as it seeks to regain investor confidence and adapt to evolving consumer behavior and a more competitive digital payments landscape.