Quick Read

- Richtech Robotics (RR) stock hit a 52-week high of $6.76 in October 2025.

- The company is expanding its AI-powered service robots into new markets and verticals.

- Recent controversies over data privacy and accounting practices have brought both scrutiny and transparency improvements.

- Analysts remain cautiously optimistic, with price targets ranging $5.50–$8.00.

- RR’s Q4 earnings and contract execution will be key for sustaining growth.

RR Stock Hits 52-Week High Amid Robotics Boom

In 2025, Richtech Robotics (NASDAQ: RR) has emerged as one of the most talked-about small-cap stocks in the robotics sector. On October 3, RR’s stock reached a 52-week high of $6.76, marking a dramatic upswing from its previous lows earlier in the year, according to Investing.com. This rally comes as investors and industry insiders increasingly bet on the future of automation in both commercial and consumer markets.

Behind the numbers is a company that’s redefined its strategy several times over the past two years. Originally known for its service robots in hospitality and retail, Richtech Robotics pivoted toward integrating advanced AI into its platforms, aiming for higher-value contracts in logistics and healthcare. The shift didn’t happen overnight, and neither did the market’s reaction. The stock languished for much of 2024 before surging in the first half of 2025, catalyzed by a series of new deals and positive analyst coverage.

What’s Fueling RR’s Rally?

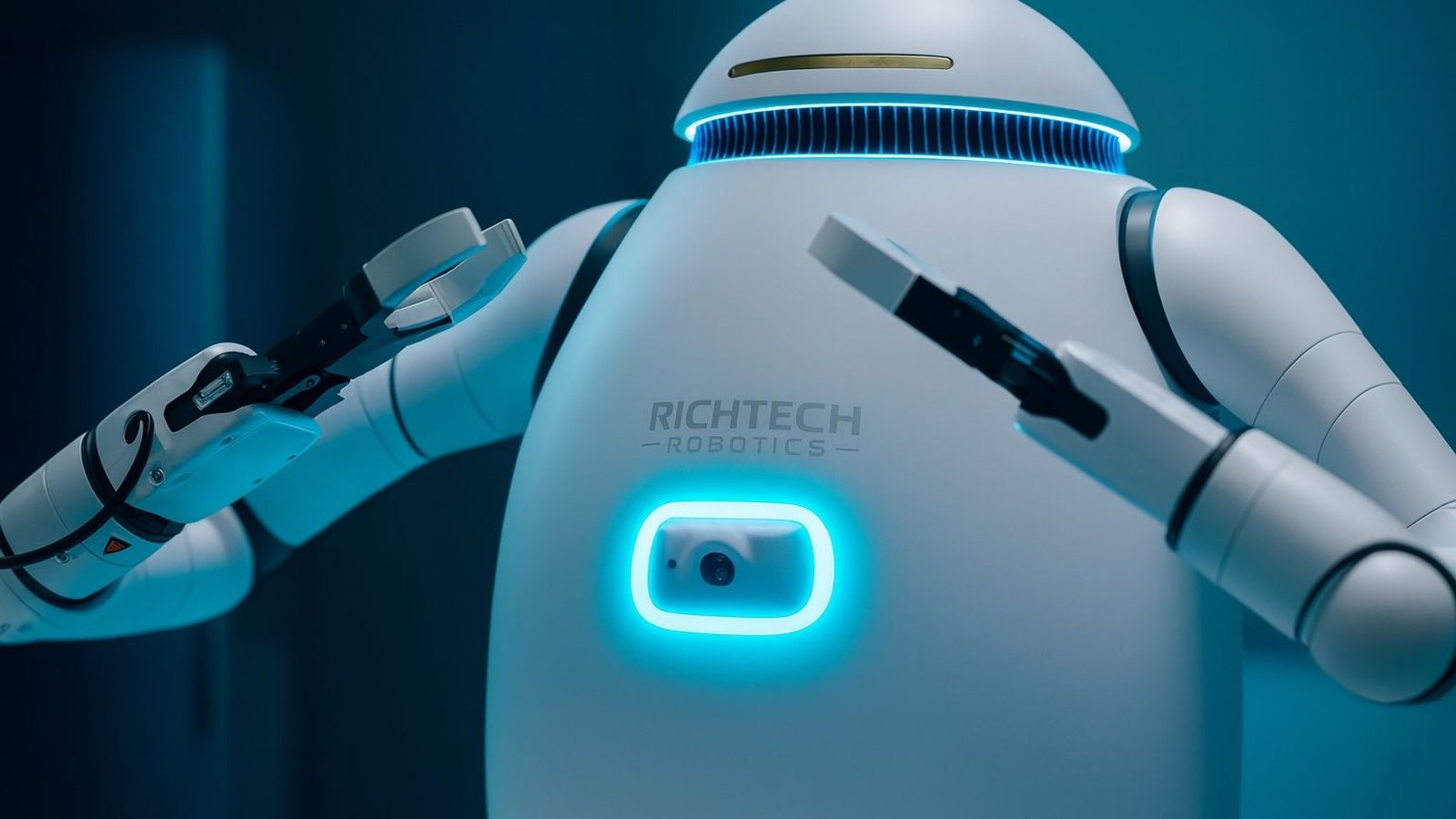

The surge in RR stock is closely tied to a broader ‘robotics rally’ that has swept through the market in 2025. With labor shortages persisting and the cost of automation falling, businesses are increasingly turning to robots for tasks ranging from warehouse picking to restaurant service. RR’s signature products, such as the ADAM robotic waiter and the GUARDIAN cleaning robot, have seen increased adoption, particularly after the company upgraded their software with generative AI features in mid-2025.

According to reports from Richtech Robotics, the company secured several large contracts with hotel chains and logistics firms in Q3, driving revenue estimates upward. Analysts now forecast RR’s full-year revenue to surpass $40 million, a significant jump compared to previous years. The company has also expanded into international markets, targeting Europe and Southeast Asia, where demand for automated solutions is rising.

Controversies and Challenges

Despite the optimism, RR’s meteoric rise hasn’t been without controversy. In early 2025, the company faced criticism over the working conditions for its manufacturing staff in China and the privacy implications of its AI-powered robots. Several consumer advocacy groups raised concerns about data collection practices in hotels and public spaces where RR’s robots operate. Richtech responded by implementing stricter privacy protocols and increasing transparency about data usage.

Investor sentiment also fluctuated after a short-seller report in March questioned RR’s accounting practices and suggested the company was overstating contract values. RR’s management quickly addressed the allegations, releasing audited financials and holding a special investor call to clarify its revenue recognition methods. While the episode caused volatility, the stock rebounded as more institutional investors took positions, attracted by the company’s growth prospects.

Analyst Views and Market Outlook

Wall Street’s view on RR remains cautiously bullish. Several analysts, including those cited by Investing.com, upgraded their price targets following the Q3 contract announcements. Targets now range from $5.50 to $8.00 per share, with the higher end reflecting expectations of continued international expansion and new product launches.

However, risks persist. Richtech Robotics is still a small player compared to giants like ABB or Fanuc, and the robotics market itself is notoriously cyclical. Any setback in contract execution or regulatory scrutiny could trigger sharp corrections. The company’s reliance on a few key customers also poses concentration risk, though management has stated that diversification is a top priority for 2026.

Looking ahead, the upcoming Q4 earnings report will be closely watched for signs of sustained revenue growth and margin improvement. Investors will want to see progress in controlling manufacturing costs and further adoption of RR’s flagship robots in new verticals. If the company can deliver, it may solidify its reputation as a breakout star in the automation revolution.

Industry Context: Automation Accelerates

Richtech Robotics’ story is emblematic of a larger shift in the tech landscape. As businesses grapple with rising labor costs and the need for greater operational efficiency, automation is no longer a luxury—it’s a necessity. The COVID-19 pandemic accelerated this trend, but it’s the advancements in AI and robotics hardware that have made large-scale deployments feasible in 2025.

RR’s focus on ‘AI-enabled service robots’ places it at the intersection of two megatrends: the rise of artificial intelligence and the proliferation of robotics in daily life. Whether it’s a robot delivering room service in a hotel or cleaning an airport terminal, Richtech’s products are increasingly visible and, for many, a sign of what the future holds.

Yet, as the company’s recent controversies show, the path to widespread adoption isn’t always smooth. Issues around privacy, job displacement, and ethical AI remain unresolved, and how RR navigates these challenges will be crucial to its long-term success.

Richtech Robotics’ rapid ascent reflects both the promise and the perils of the robotics boom. Its ability to innovate, address public concerns, and secure diverse revenue streams will determine whether RR becomes a lasting leader or a fleeting phenomenon in the automation era.