Quick Read

- The Russell 2000 index reached a new all-time high in early 2026, signaling a robust ‘risk-on’ sentiment.

- The index broke out in late 2025 after struggling at the 2460 level for several years.

- Bitcoin’s price is targeting $100,000, fueled by the Russell 2000’s rally, as per CryptoTicker.

- Ethereum’s correlation with the Russell 2000 is weakening, suggesting a shift in market dynamics, as noted by Coindoo.

- The S&P 500 also hit a fresh all-time high, while the Nasdaq 100 shows a bullish formation for a potential re-test of its ATH.

The Russell 2000 index, a key benchmark for U.S. small-cap stocks, has surged to a new all-time high in early 2026, marking a significant shift in market dynamics after years of underperformance. This breakout signals a renewed “risk-on” sentiment across traditional finance, notably impacting cryptocurrencies like Bitcoin, while prompting new questions about traditional correlations as Ethereum’s relationship with small-caps appears to be weakening. The rally is unfolding against a backdrop of anticipated fiscal stimulus and evolving investor strategies.

Small-Cap Surge Signals Broader Market Shift

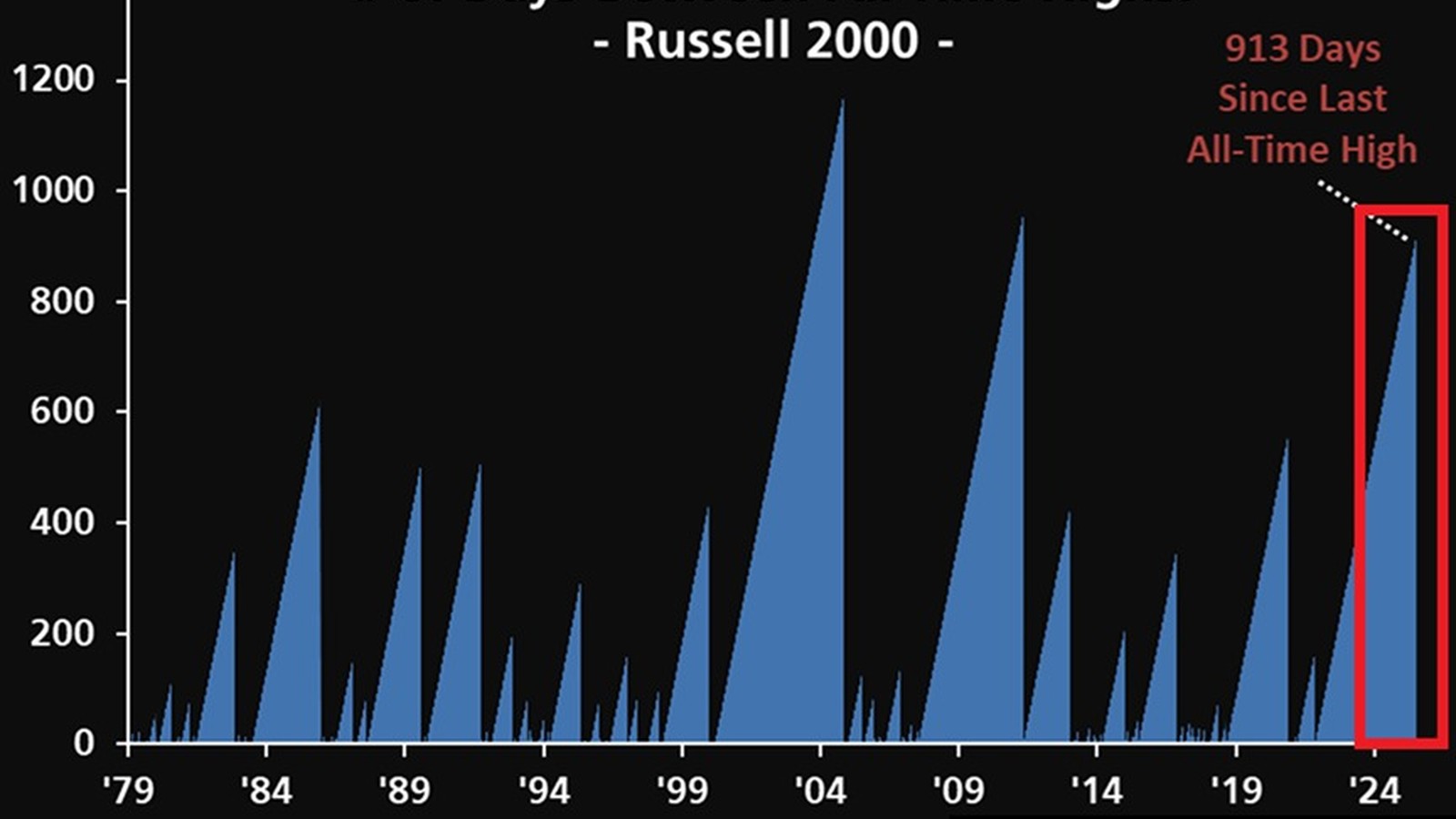

For several years, the Russell 2000 struggled to overcome the critical 2460 level, which acted as a formidable resistance point in both 2021 and 2024. However, buyers finally prevailed in late 2025, initiating a “sizable rally” that has extended into the opening weeks of 2026. This breakout is particularly significant as small-cap stocks are often seen as bellwethers for broader economic recoveries, reflecting investor confidence in domestic growth prospects.

According to analysis from Forex.com, the current technical structure of the Russell 2000 indicates new support levels. The 2605 and 2556 marks are identified as immediate potential support zones, while the previous formidable resistance spanning 2460 to 2500 is now expected to act as a crucial “s3” support. A sustained hold above this zone is essential for bulls to maintain the broader breakout. The surge is also seen as illustrative of a “hunt for value” as markets begin to price in potential fiscal stimulus, specifically referencing President Trump’s anticipated “Big Beautiful Bill.” While still speculative, the expectation of such stimulus is fueling investor optimism, contributing to the index’s upward trajectory.

Crypto Markets React Differently to Risk-On Sentiment

The Russell 2000’s rally has had a discernible, though varied, impact on the cryptocurrency market. Bitcoin, the leading digital asset, appears to be a direct beneficiary of the heightened risk appetite. CryptoTicker reported on January 16, 2026, that Bitcoin was “eyeing $100k as the Russell 2000 rallies,” explicitly connecting the small-cap breakout to a “massive risk-on rally for BTC.” Bitcoin’s performance in early 2026 has been notable, with the asset hitting $96,500 and even surging above $97,000, demonstrating a decoupling from a sliding Nasdaq and asserting its position as a “Digital Gold” amidst institutional rotation.

In contrast, Ethereum, often considered crypto’s high-beta asset due to its quick and forceful response to changes in investor sentiment, is showing a weakening correlation with the Russell 2000. Coindoo highlights that after several aligned market cycles, the “lockstep” movement between Ethereum and US small-cap stocks is fading. Despite the Russell 2000’s positive year-over-year performance, Ethereum is no longer reacting with the same vigor as in earlier periods. This divergence suggests a potential shift in the global risk regime or indicates that crypto markets, particularly Ethereum, may be pricing future conditions ahead of traditional finance. The muted response from ETH, despite a generally constructive equity environment, points to a changing market dynamic where traditional risk indicators may be losing some reliability during macro transitions.

Navigating the Equity Landscape: SPX and Nasdaq Trends

Beyond small-caps, other major U.S. equity indices are exhibiting their own distinct patterns. The S&P 500 (SPX) has also seen a fresh all-time high recently, but its daily chart shows prices grinding into a tighter range, forming a long-term ascending wedge. While such formations are typically considered bearish reversal patterns, buyers have maintained control, with early-week pullbacks finding support at key trendlines. Forex.com notes that buyers “remain in-control of SPX,” even as the index navigates this complex technical structure.

Meanwhile, the Nasdaq 100 has not set a fresh all-time high since October 29th of last year. However, it is displaying a bullish ascending triangle formation, characterized by higher-lows developing over time. This pattern suggests the possibility of a re-test of its prior all-time high at 26,182. The varied technical pictures across the S&P 500 and Nasdaq 100, alongside the Russell 2000’s robust breakout, underscore a market where different segments are responding to macro forces with distinct sensitivities and trajectories.

What’s Driving the Rally and What’s Next?

The current market rally is fueled by a combination of factors, including the optimistic outlook for fiscal stimulus and sustained institutional interest. The “industrialization” of certain crypto assets, as seen with XRP’s regulatory clarity and ETF inflows (totaling over $1.2 billion since November 2025 according to CryptoTicker), contributes to a broader sense of institutional adoption in the digital asset space, which can indirectly bolster overall risk appetite. Ripple’s new USD-backed stablecoin (RLUSD) and its ambitions to disrupt SWIFT’s payment volumes also highlight the maturation of the crypto ecosystem.

Despite the bullish momentum, market volatility remains a constant. Investors are advised to exercise patience, particularly regarding “chasing fresh highs.” Forex.com suggests that pullbacks demonstrating strong support, similar to those seen recently, offer more attractive entry points than simply buying into extended rallies. The clearing of regulatory clouds for some crypto assets, coupled with the ongoing integration into global financial infrastructure, positions the market for continued evolution, though careful risk management remains paramount.

The Russell 2000’s ascent to an all-time high unequivocally signals a heightened appetite for risk in early 2026, driven by a confluence of economic expectations and a sustained hunt for value. However, the concurrent divergence in the behavior of major cryptocurrencies, particularly Ethereum’s muted response compared to Bitcoin’s aggressive rally, underscores a sophisticated market where traditional correlations are being re-evaluated, suggesting that while capital flows are abundant, investors are increasingly selective about where they deploy risk.