income tax

-

IRS Updates 2025 Tax Brackets as April 15 Deadline Nears

The Internal Revenue Service (IRS) is actively processing 2025 income tax returns, with the crucial April 15, 2026 deadline fast approaching. Taxpayers are urged to familiarize themselves with the recently adjusted federal tax brackets and leverage available free filing resources…

-

Tax Refund Delays Prompt New Focus on Filing Accuracy

India’s Central Board of Direct Taxes confirms most pending income tax refunds will be released in February 2026, while global tax authorities highlight common errors causing delays.

-

Resolution Foundation’s Tax Blueprint Shapes UK’s Fiscal Future

The Resolution Foundation’s influential tax proposals, including a switch from national insurance to income tax, are igniting political debate and could redefine the UK’s budget strategy under Rachel Reeves.

-

Indian ITR Refund 2025: When Taxpayers Can Expect Their Money

After a record number of income tax returns filed by the September 16 deadline in India, millions are now watching their bank accounts for the awaited refund. Here’s how the process works, why some refunds come instantly while others stall,…

-

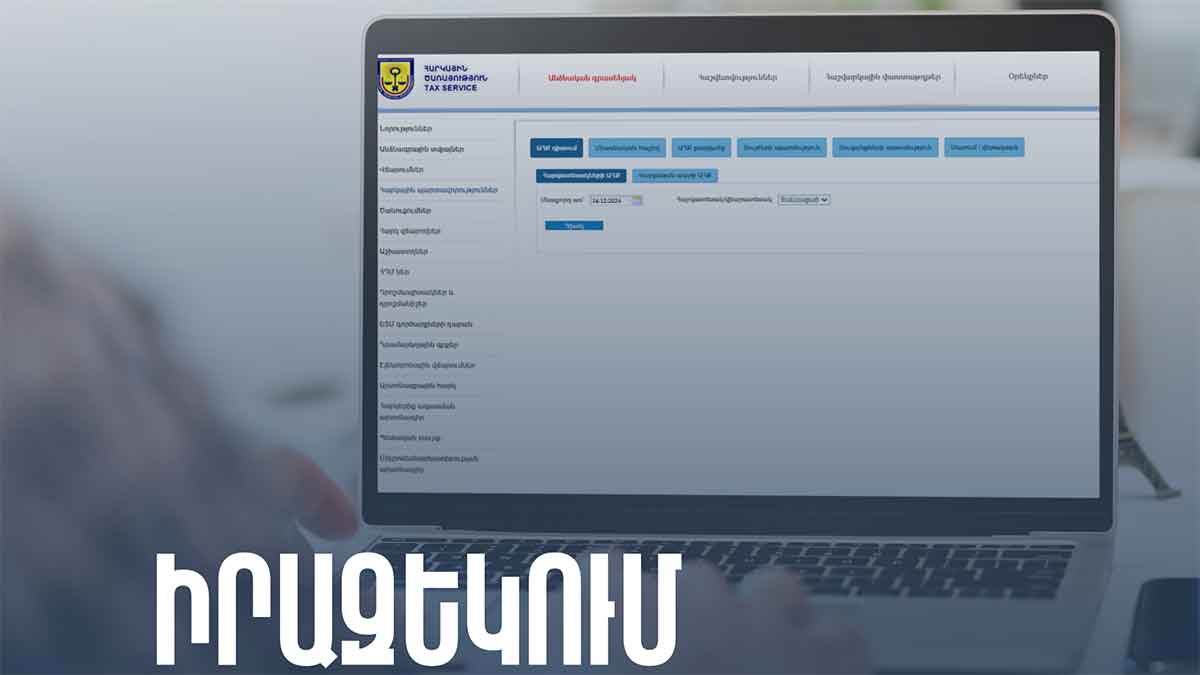

Mortgage Tax Rebates in 2025: Application Window Opens January 15

The State Revenue Committee (SRC) of Armenia has announced the availability of its electronic services following a brief period of maintenance. The SRC stated that, as of 5:00 PM on January 3rd, the following electronic systems became accessible: the SRC…

-

Armenia Implements Regional-Based Mortgage Tax Return Policy for 2025

The State Revenue Committee of Armenia has announced significant modifications to the mortgage tax return policy, introducing a geographically differentiated approach effective January 1, 2025. This strategic reform marks a pivotal shift in Armenia’s housing policy, implementing region-specific regulations while…

-

Support Program for Unrecoverable Loans to Launch in February 2025

Starting February 1, 2025, Armenia will launch a support program aimed at assisting individuals with unrecoverable loans. The program’s primary objective is to help borrowers transition out of informal (shadow) employment and restore their economic activity. Eligible participants are individuals…