Quick Read

- AST SpaceMobile shares soared by 13.1% on speculation of discussions with Amazon or Blue Origin.

- An Instagram post featuring AST’s CEO and Jeff Bezos sparked investor interest.

- Analysts suggest AST’s RF technology could complement Amazon’s Project Kuiper satellite initiative.

- AST recently hit a significant milestone in semiconductor production for its satellite network.

- Investors are advised to weigh risks as the company remains in its pre-revenue phase.

Shares of AST SpaceMobile (NASDAQ: ASTS) experienced a notable surge of 13.1% earlier this week, driven by speculation of potential collaboration or even acquisition discussions with Amazon and Jeff Bezos’ space venture, Blue Origin. As of Tuesday, the company’s stock had climbed significantly before settling at an 18.5% gain, marking one of its most active trading sessions in recent months.

Speculation ignited by a social media post

The spark behind this rally can be traced to an Instagram post shared by Adriana Cisneros, a board member of AST SpaceMobile and its first institutional investor. The post, uploaded on Monday night, featured Cisneros alongside AST CEO Abel Avellan and Amazon founder Jeff Bezos. The photograph immediately fueled speculation about potential strategic discussions between the companies.

Notably, Blue Origin already has an existing contract with AST to launch 45 satellites, with an option for 15 additional launches in the future. These satellites are central to AST’s ambitious goal of providing global mobile connectivity in areas without terrestrial infrastructure. According to Scotiabank analyst Andres Coello, a partnership or acquisition could align well with Amazon’s Project Kuiper, which aims to deliver satellite-based broadband services. Coello noted that AST’s radio frequency (RF) technology could complement Kuiper’s capabilities, creating mutual synergies (Fool).

Major milestone in satellite technology development

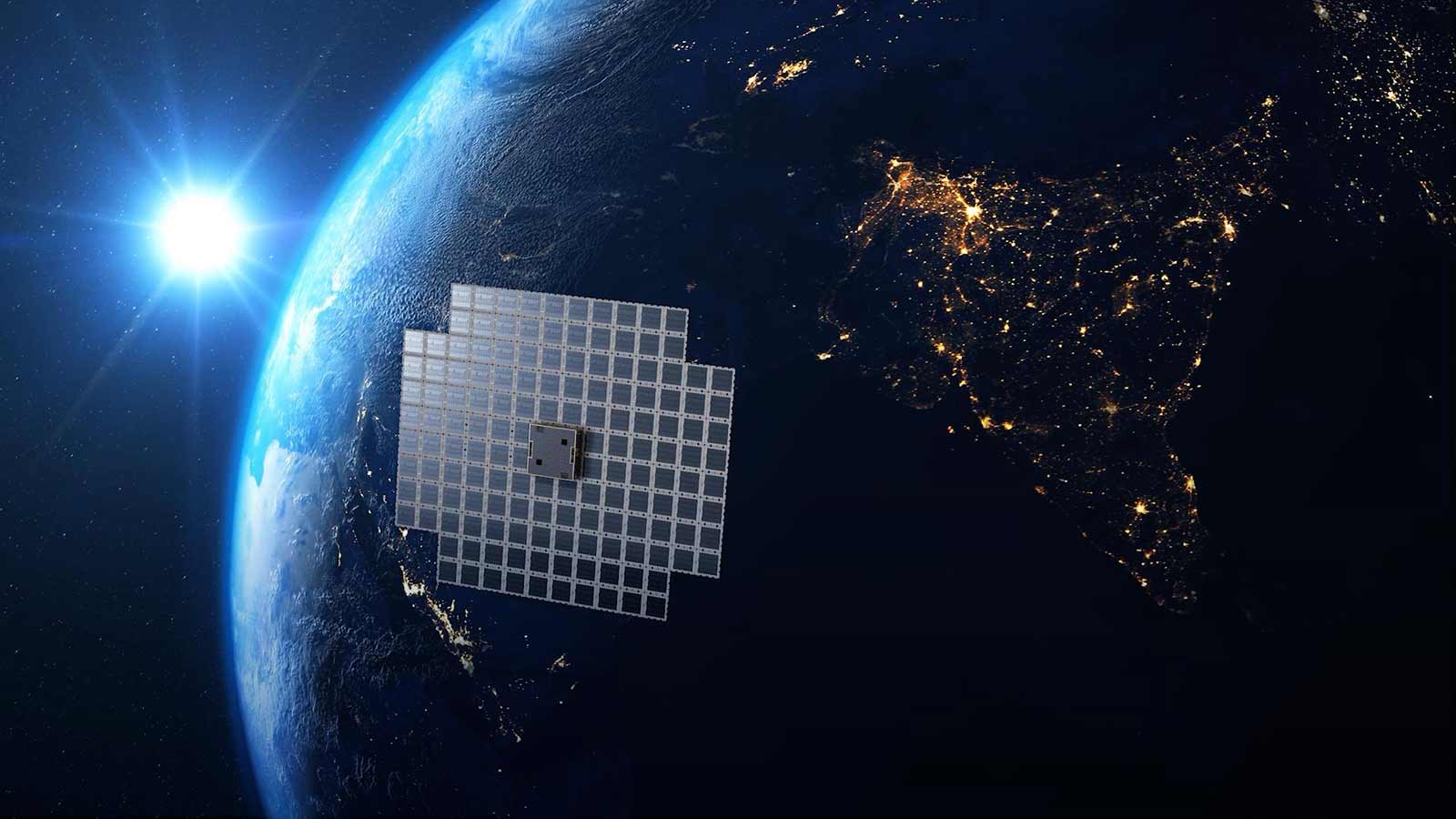

While investor excitement largely revolves around speculation, AST SpaceMobile has also achieved tangible progress in its operations. On Wednesday, the company announced it had entered the “tape-out” phase for its Application-Specific Integrated Circuit (ASIC), a critical milestone in semiconductor manufacturing. This phase transitions designs into physical production, bringing AST closer to realizing its vision of a space-based cellular broadband network accessible via standard smartphones.

The ASIC, developed in collaboration with Taiwan Semiconductor Manufacturing Company (TSMC), is integral to AST’s Block 2 satellite program. CEO Abel Avellan stated, “This milestone brings us closer to empowering people with reliable connectivity, regardless of their location” (Finance). The company has already invested $45 million in the development of this low-power, high-bandwidth semiconductor, which will serve commercial and governmental clients alike.

Financial context: A pre-revenue company with growth challenges

Despite these advancements, AST SpaceMobile remains a pre-revenue company, a status that carries inherent risks for investors. Earlier this year, the company raised additional capital through a public share offering, which contributed to a 40% decline in its stock value year-to-date (MarketBeat). This fundraising underscores the financial challenges the company faces as it works to scale its operations.

However, with agreements already in place with over 40 mobile network operators globally—representing more than 2 billion subscribers—AST’s growth potential is substantial. The company also holds $1 billion in cash reserves to fund its ongoing expansion initiatives, providing a strong foundation for future development (Finance).

Analysts weigh in on acquisition rumors

While the Instagram post has fueled acquisition rumors, analysts urge caution. Historically, potential buyouts often fail to materialize, and regulatory hurdles can further complicate such deals. Scotiabank’s Coello emphasized that investors should evaluate AST on its own merits, rather than solely on the prospect of acquisition. The company’s proprietary RF technology and partnerships with major telecom operators form a strong value proposition, but the road to profitability remains uncertain (Fool).

Meanwhile, equity analysts have provided mixed ratings on AST’s stock. UBS Group recently raised its price target to $38, citing the company’s technological advancements and growth potential. However, other analysts caution that the market for satellite-based telecommunications remains competitive, with players like SpaceX’s Starlink also vying for dominance (MarketBeat).

As AST SpaceMobile progresses toward its ambitious goals, the company finds itself at the intersection of innovation and speculation. While the potential for partnerships with industry giants like Amazon is enticing, the company’s success will ultimately depend on its ability to execute its vision of global satellite connectivity.