Quick Read

- CapCut ranked as the fourth most-downloaded app in the U.S. in 2025, climbing three positions from the previous year.

- The ByteDance-owned video editing tool achieved this despite ongoing U.S.-China geopolitical tensions and scrutiny over Chinese-linked apps.

- Its sibling app, TikTok, also remained the second most-downloaded app in the U.S. in 2025.

- Other China-originated apps like Temu and Shein also showed strong performance, adapting to tariffs and policy changes.

- Consumer preference for engaging content, affordability, and convenience is cited as a key driver for their success.

CapCut, the popular video editing application owned by Beijing-based ByteDance, defied significant geopolitical headwinds by ranking as the fourth most-downloaded app in the U.S. in 2025. This remarkable climb of three places from the previous year, according to data from Sensor Tower, underscores the enduring appeal and adaptive strategies of China-originated digital platforms among American consumers, even amidst intense scrutiny and policy pressures targeting its parent company, which also owns TikTok.

CapCut’s Ascendant Performance in the U.S. Market

The success of CapCut is particularly noteworthy given the challenging environment faced by its parent company. ByteDance’s flagship app, TikTok, continued to dominate the U.S. market, ranking as the second most-downloaded app across Apple’s App Store and Google Play in 2025. This occurred even as TikTok navigated years of intense scrutiny and the looming threat of a ban over its ties to China, ultimately culminating in a new U.S. venture deal.

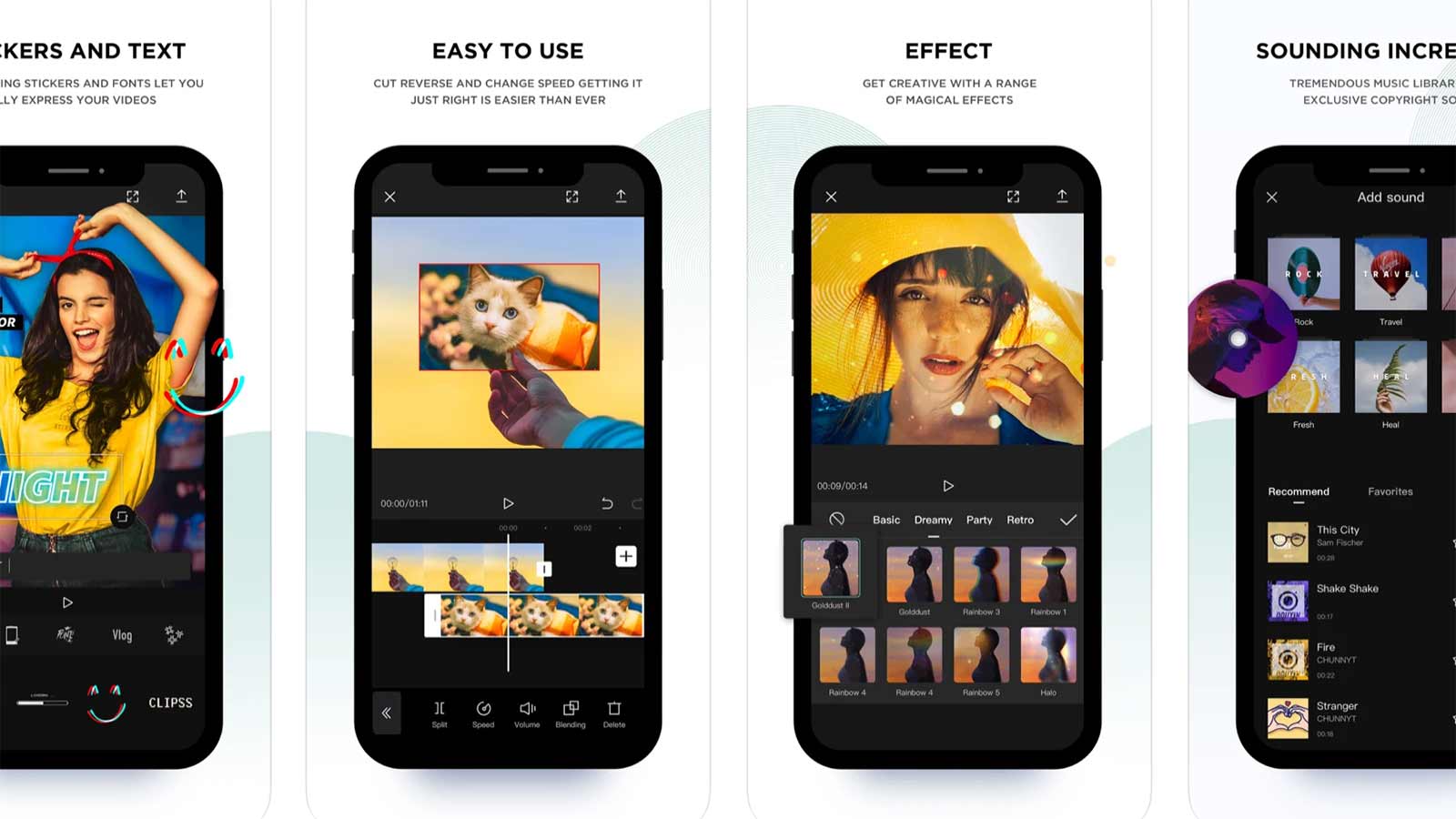

CapCut’s ascent to the fourth position, behind only OpenAI’s ChatGPT (the most downloaded app) and TikTok, signals a robust user base and growing reliance on its video editing capabilities. The app’s user-friendly interface and comprehensive suite of editing tools have evidently resonated with a wide segment of American users, from casual content creators to social media influencers, solidifying its place in the competitive app ecosystem.

Resilience Amidst Geopolitical Headwinds

The strong performance of CapCut and other China-linked applications, including e-commerce giants Temu and Shein, occurred against a backdrop of escalating U.S.-China tensions. In 2025, TikTok faced months of uncertainty, with the Supreme Court upholding a law in January that effectively banned the app from U.S. app stores unless ByteDance divested. This law, signed by President Joe Biden in April 2024, cited national security concerns over potential Chinese government access to user data for surveillance or influence operations.

Despite TikTok briefly going dark in January, the ban was never fully enforced, as President Donald Trump repeatedly extended the law’s deadline while negotiating a divestment deal. This period of uncertainty, however, did not deter consumers. Professor Liang Chen, a Professor of Strategy & Entrepreneurship at Singapore Management University, told CNBC that 2025 demonstrated these China-originated apps are not merely ‘policy arbitrageurs, but are adaptive ecosystems with governance capabilities on both the demand and supply sides.’

Similarly, Temu and Shein thrived despite new tariffs imposed by the Trump administration, including the closure of the “de minimis” trade loophole on May 2, which had allowed packages valued under $800 to enter the U.S. duty-free. These companies adapted by negotiating lower supplier prices, absorbing levy costs, and diversifying supply networks beyond China, showcasing a significant capacity for commercial resilience.

The ‘Secret Sauce’ of Engagement and Affordability

Analysts attribute the sustained popularity of apps like CapCut, TikTok, Temu, and Shein to their attention-driven platforms, sophisticated algorithms, affordability, and convenience. Scott Miller, CEO of e-commerce consulting firm pdPlus, highlighted to CNBC that their success reflects a fundamental shift in demand generation, moving from traditional marketing to a ‘continuous, attention-economy strategy.’

American consumers, Miller explained, are increasingly discovering products through highly engaging, viral, and personalized content, making demand creation a function of entertainment and constant digital presence. These algorithms, while effective, have also drawn scrutiny from U.S. regulators over national security and data privacy concerns, particularly regarding their potential for manipulation by foreign governments and extensive data collection practices.

However, these concerns appear to have a limited impact on consumer behavior. Yao Jin, an associate professor of supply chain management at Miami University, observed that American consumers generally do not prioritize an app’s country of origin “as long as they can find something they want at an affordable price.” This focus on value and convenience, Jin stated, is precisely the competitive advantage of most China-originated apps.

Economic Impact and Forward Outlook

The economic impact of these platforms in the U.S. market remains substantial. TikTok’s U.S. revenues, encompassing ad revenue, in-app purchases, and commerce, rose by 26.2% year-over-year to $13.9 billion in 2025, following 25.7% growth in 2024. Meanwhile, Temu’s gross merchandise values increased by 21.8% to $27.4 billion, and Shein’s U.S. revenue grew by 16.8% to $14.6 billion.

Xiaomeng Lu, director of geo-technology at Eurasia Group, characterized TikTok’s 2025 success as demonstrating ‘a path to navigate geopolitical headwinds despite the continuously deteriorating U.S.-China relationship — a rare case of clever commercial strategy triumphing over politics.’ As these apps continue to adapt their logistics, merchant mix, and incentive designs, they prove capable of responding to policy shocks faster than consumer habits can shift.

The sustained high performance of CapCut and other China-originated applications in the competitive U.S. market, especially in the face of significant political and regulatory challenges, illustrates a potent dynamic where consumer demand for engaging, affordable, and convenient digital services often outweighs geopolitical concerns and policy interventions.