Quick Read

- Gold price reached $4,400/oz in December 2025, up $1,794 from last year.

- Recent volatility followed record highs and investor profit-taking amid Ukraine peace talks.

- Gold demand surged on inflation, weak dollar, and global uncertainty; experts urge caution despite the rally.

Gold has always been the investment world’s reliable anchor during stormy economic weather. But in December 2025, it’s not just steady—it’s breaking records. The price of gold surged to $4,400 per ounce as of December 29, a staggering $1,794 jump from the same time last year, according to Fortune. It’s a rise that’s left seasoned investors recalibrating and newcomers scrambling for insight. What’s fueling this historic climb, and does it signal stability or volatility ahead?

To start, the numbers alone tell a story of seismic change. Just one year ago, gold sat at $2,606 an ounce. By late December 2025, after a flurry of economic uncertainty and geopolitical drama, the metal soared to $4,400. That’s a one-year gain of nearly 75%, the highest annual increase seen in decades, as confirmed by Yahoo Finance.

But the journey to these heights hasn’t been smooth. In fact, the last days of December delivered a wild ride. Gold futures opened at $4,568 per ounce Monday morning—an all-time high—before dropping below $4,500. The cause? A potent mix of investor profit-taking and breaking news about reported progress in Ukraine peace talks. Traditionally, gold demand surges in times of conflict and uncertainty; so when geopolitical tensions cool, as they did with positive signals from President Trump and Ukrainian President Zelenskyy, some of the heat comes off the gold market.

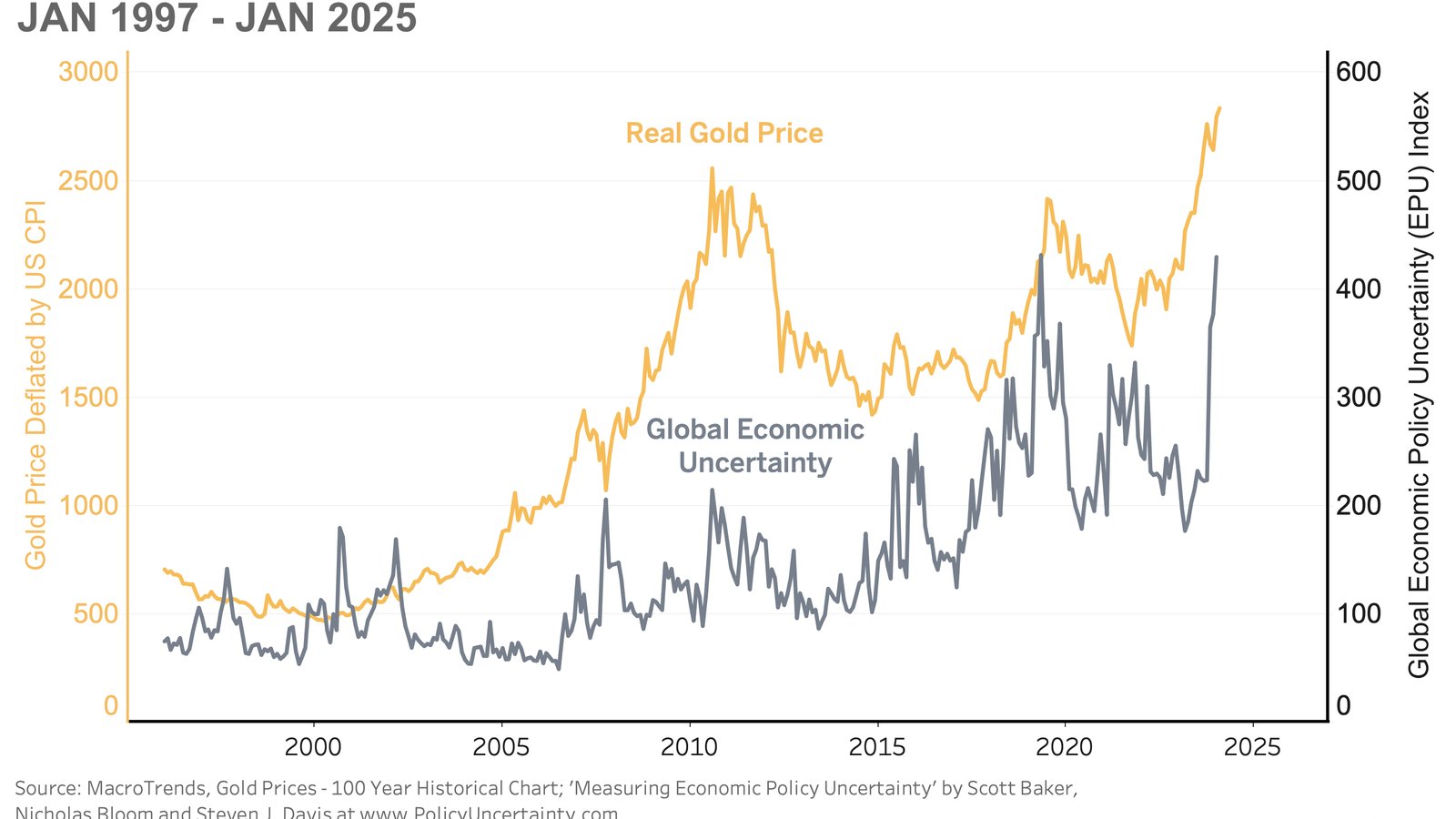

Beyond headlines, the underlying trends have been at work all year. The U.S. dollar weakened throughout 2025, interest rates fell, and the world watched inflation stubbornly persist. These conditions have historically driven investors—both institutional giants and everyday savers—to gold as a hedge against inflation and a store of value. With stock markets struggling to hold new highs and currencies fluctuating, gold’s appeal as a safe haven has rarely been stronger.

Yet, December’s gold rush wasn’t isolated. Other precious metals—silver, platinum, and palladium—also saw dramatic swings. Silver, for example, peaked at $83.90 per ounce before plummeting 14% in a single session, triggered by China’s market chaos and social media-fueled speculation, as reported by BullionVault. China’s photovoltaic (solar) sector, previously a major driver of silver demand, began thrifting due to soaring prices, further shaking the metals market.

Gold’s price is shaped by a web of factors: supply and demand, central bank buying, inflation rates, mining production, and global events. The spot price—what you’d pay for gold today in an over-the-counter trade—is a direct reflection of immediate demand. When futures prices outpace the spot price (a scenario called “contango”), it signals expectations of higher costs ahead, often due to storage or speculative pressure. Conversely, “backwardation” (futures below spot) can indicate oversupply or waning demand.

For those weighing their investment options, gold offers several paths. You can buy physical gold—bars, coins, or jewelry—or opt for paper gold like exchange-traded funds (ETFs) and gold mutual funds. Each method comes with its own risks and benefits. Physical gold requires secure storage and insurance, while ETFs and funds provide liquidity and easier portfolio management. Financial advisors like James Taska note that ETFs make it simpler to rebalance holdings, especially in turbulent times.

The market’s liquidity is another critical piece. The difference between the bid price (what buyers will pay) and the ask price (what sellers want) is known as the spread. A narrow spread signals robust demand and easy trading, while a wide spread can indicate uncertainty or low market activity.

So, is now a good time to invest in gold? Experts agree: gold’s role as a portfolio diversifier and inflation hedge remains intact, especially with prices at all-time highs. However, they caution that gold isn’t a guaranteed home run. In strong economies, stocks have historically delivered higher returns—averaging 10.7% annually from 1971 to 2024, compared to gold’s 7.9%.

Looking ahead, the outlook for gold is shaped by ongoing economic flux. Central banks continue buying, inflation remains stubborn, and global events—from peace talks to trade disruptions—can shift sentiment overnight. For now, gold stands tall as a symbol of security in an unpredictable world, but investors should remain alert to the forces that can send prices swinging.

Analysis: The story of gold in 2025 is one of both opportunity and caution. Its meteoric rise reflects deep-seated anxiety about inflation and global stability, but recent volatility—spurred by profit-taking and shifting geopolitical winds—shows just how quickly sentiment can change. For investors, gold remains a cornerstone, but it’s not immune to the unpredictability of today’s markets. Diversification and vigilance are essential as the world enters another year of economic uncertainty.