Quick Read

- SoundHound AI stock fell over 40% in 2025, reflecting investor concerns over its valuation.

- Public companies and individual investors own 61% of SOUN; Vanguard is the largest institutional holder.

- Analysts have a Moderate Buy consensus on SOUN, with an average price target suggesting 65% upside.

- Ambarella, a rival edge AI chipmaker, is growing fast and could surpass SoundHound’s market cap in 2026.

- Energy costs and infrastructure are emerging as critical factors in the AI sector’s future.

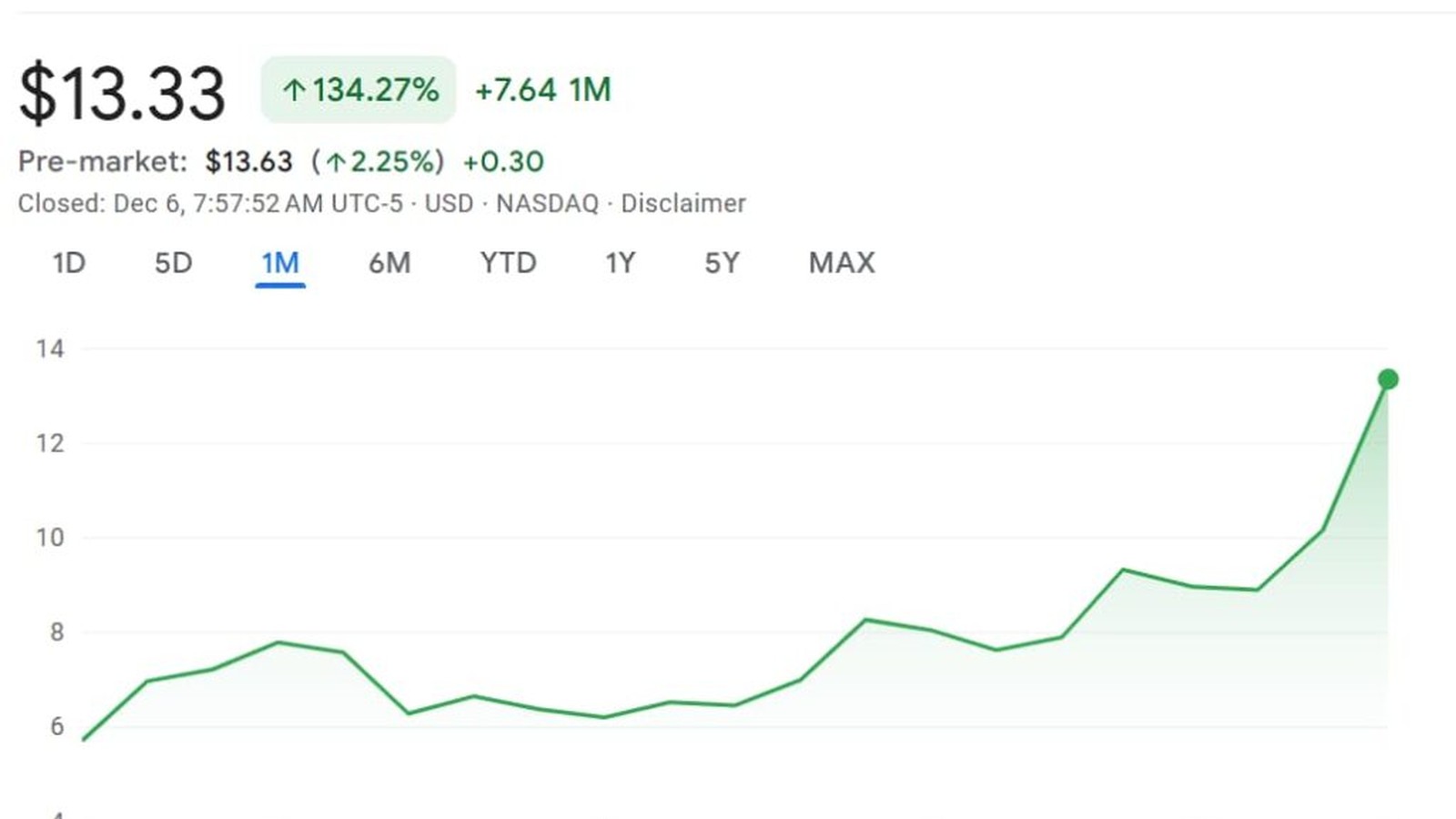

SoundHound AI (NASDAQ: SOUN) entered 2025 riding the wave of the artificial intelligence boom, but the year turned out to be a reality check for investors. After a meteoric rise in 2024, the stock shed more than 40% of its value this year, leaving many to ask: what’s really driving SOUN, and where does it go from here?

The answer starts with its business model. SoundHound AI specializes in voice AI solutions—think conversational bots and automated assistants—for industries ranging from automotive and hospitality to finance. Its technology powers everything from car infotainment systems to customer service platforms, making it a name synonymous with cutting-edge AI voice applications.

But in 2025, the spotlight shifted from potential to performance. While SoundHound’s technology remains in demand, its stock valuation raised eyebrows. According to TipRanks, SOUN trades at a rich 32 times sales, even after the dramatic price drop. For context, the average sales multiple for U.S. tech stocks is less than a third of that, sparking debates about whether SoundHound’s growth prospects justify such a premium.

Ownership data offers another lens into the company’s trajectory. Public companies and individual investors collectively hold more than 61% of SOUN shares. ETFs, mutual funds, and other institutional investors round out the picture, with Vanguard leading the pack: the investment giant owns roughly 10% of outstanding shares, while its index funds and ETFs add several more percentage points. The iShares Russell 2000 ETF also has a meaningful stake. This broad base signals mainstream confidence, but also exposes SOUN to the whims of market sentiment and sector trends.

Wall Street remains cautiously optimistic. Analyst Scott Buck at H.C. Wainwright has set a Street-high price target of $26, highlighting SoundHound’s improving margins and progress toward profitability. Cantor Fitzgerald’s Thomas Blakey recently upgraded the stock, raising his target to $15, and cited the company’s steady development in voice and conversational AI services as a key driver. The consensus rating? Moderate Buy, with an average price target of $17.33—about 65% above current levels. Still, even bullish voices acknowledge that expectations are “modest” heading into 2026, suggesting that SoundHound’s future growth must be earned, not assumed.

Yet, there’s another side to the story. Competitors are circling. Ambarella, a chipmaker specializing in edge AI hardware, is poised to capitalize on the growing demand for local data processing in devices like security cameras and autonomous vehicles. In 2025, Ambarella’s revenue surged by 37%, with its AI-capable processors making up a larger slice of its business each year. The company’s earnings jumped 145% in the latest quarter, and margins are climbing thanks to higher average selling prices. Ambarella now trades at less than five times sales—a steep discount compared to SoundHound. If current trends continue, analysts predict Ambarella could overtake SoundHound’s market cap in 2026.

Why does this matter? Because it forces investors to confront a classic dilemma: growth versus value. SoundHound’s story is all about rapid expansion, big ideas, and a future powered by AI. But the market is increasingly scrutinizing whether its lofty valuation reflects real-world results. Meanwhile, rivals like Ambarella are quietly building momentum on solid financials and lower multiples, suggesting that the next AI leader may not be the one with the flashiest technology, but the one with the most sustainable business model.

Underlying all this is the broader energy crisis facing the AI sector. As Insider Monkey notes, the machines that drive AI—from ChatGPT queries to robotic breakthroughs—consume staggering amounts of electricity, pushing global power grids to the brink. The race to expand data center capacity and secure reliable energy is now as crucial as software innovation. Companies with stakes in energy infrastructure, or those able to profit from the surge in demand, are becoming unexpected winners in the AI gold rush.

For investors, the stakes are high. SoundHound offers exposure to voice AI—a niche with long-term promise—but the stock is no longer an under-the-radar play. Its valuation, ownership structure, and competition from companies like Ambarella mean that every quarterly report could shift sentiment. The sector is flooded with talent and capital, but also faces the hard limits of power and infrastructure. Betting on SOUN is a wager on both its technology and its ability to navigate a rapidly evolving landscape.

The bottom line? SoundHound AI remains a key player in the voice AI space, with strong institutional backing and analyst support. But with its valuation under the microscope and rivals gaining ground, the next chapter will be defined by execution, not just innovation. Investors must weigh the promise of AI against the realities of market cycles, energy demands, and competitive pressure—because in 2025, the future of SOUN is anything but certain.

SoundHound AI stands at a crossroads. Its impressive technology and broad investor base provide a foundation, but the pressure to deliver sustainable growth in the face of rising competition and energy costs is mounting. The next year will test whether SOUN can justify its premium, or if the market will reward those with more grounded financials. In the world of AI, disruption is constant, but only those who adapt will lead.