Interest Rates

UK Graduates Grapple with Rising Student Loan Debt, New US Policies Emerge for 2026

New policies for 2026 highlight a global divergence in student loan management, with UK graduates facing escalating debt despite repayments due to high interest and frozen thresholds, while the US introduces new income-driven plans and potential forgiveness changes.

Australia’s Jobless Rate Drop Sparks Rate Hike Predictions

Australia’s jobless rate hit a seven-month low, fueling speculation of a Reserve Bank interest rate hike in February.

Canada’s Inflation Outlook: Rate Cut Hopes Dim Amid Steady Core Data

Canada’s December headline inflation edged up to 2.4%, slightly above forecasts, prompting BMO Economics to declare insufficient evidence for Bank of Canada interest rate cuts. Despite mixed signals, core inflation measures showed meaningful improvement and convergence, aligning with the central…

Private Credit Funds Face $7 Billion Withdrawals Amid Investor Unease

Investors withdrew over $7 billion from Wall Street’s private credit funds in late 2025, signaling growing unease in the rapidly expanding sector. The pullback is driven by corporate bankruptcies, governance concerns, and anticipated lower interest rates, marking a critical shift…

Mortgage Markets Adjust Amid Policy Shifts and Evolving Islamic Views

Global mortgage markets are experiencing significant shifts, from the U.S. housing sector returning to historical interest rate norms and China implementing stimulus measures, to a nuanced re-evaluation of mortgage interest within Islamic jurisprudence. These developments underscore diverse challenges and adaptive…

Trump’s Bold Economic Gambit: Challenging the Fed, Credit Cards, and Housing Affordability

President Trump’s administration is aggressively targeting the Federal Reserve’s independence, proposing a 10% cap on credit card interest rates, and banning institutional investors from buying single-family homes to combat inflation and boost affordability, sparking both hope and concern among experts.

Trump’s 10% Credit Card Interest Cap: Banks Vow Fight Amid Economic Fears

President Donald Trump’s executive order for a temporary 10% cap on credit card interest rates has sent shockwaves through the financial sector, sparking immediate market declines and strong opposition from banking associations who warn of dire consequences for consumer credit…

US 10-Year Treasury Yields Dip Amid Venezuelan Tensions and Fed Rate Cut Hopes

The US 10-year Treasury note yield edged down to 4.17% amidst escalating geopolitical tensions in Venezuela and anticipation of crucial US economic data, with markets pricing in potential Federal Reserve interest rate cuts in 2026.

Yorkshire Building Society Urges Savers: £5,001+ in UK Bank Accounts Means Lost Interest

Yorkshire Building Society warns millions of UK savers: keeping over £5,001 in current accounts means missing out on billions in potential interest. New research reveals widespread financial stress and falling festive spending as Britons fail to move idle funds into…

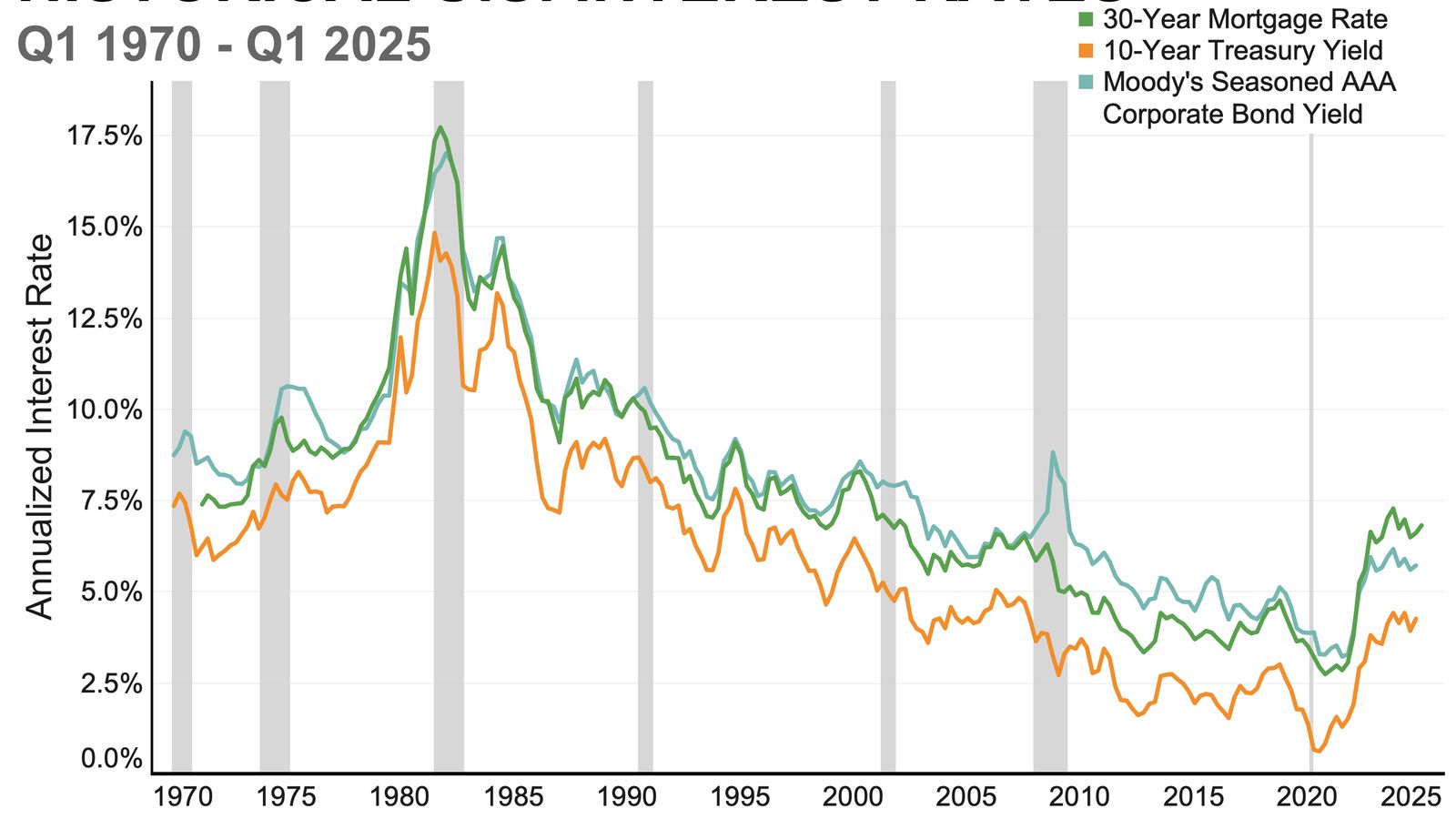

10-Year Treasury Yield Trends: What 2026 Means for Rates, Mortgages, and Investors

As investors look ahead to 2026, the 10-year Treasury yield is under scrutiny for its impact on mortgage rates and broader borrowing costs. Experts weigh in on inflation, labor market signals, and central bank policies shaping the outlook.

Interest Rates Slashed to 3.75%: What the Bank of England’s Fourth Cut Means for UK Borrowers, Savers, and the Economy

The Bank of England has cut interest rates to 3.75%, its lowest since early 2023, as policymakers respond to falling inflation and sluggish economic growth. Discover how this decision affects mortgages, savings, and the broader UK economy—and what might come…

Bank of England Cuts Interest Rate to 3.75%: What It Means for Borrowers, Savers, and the Economy in 2025

The Bank of England has lowered its key interest rate to 3.75% after a tight vote, marking the lowest level in nearly three years. With inflation slowing and economic growth stagnant, the move offers relief for borrowers but raises questions…

Federal Reserve Cuts Rates Amid Deep Divisions, Future Policy Uncertain

The Federal Reserve approved its third interest rate cut of 2025, but deep internal divisions and political pressure have cast doubt on the future direction of US monetary policy.

Mortgage Loans in 2025: Rates, Refinancing Options, and How ARMs Stack Up

An in-depth look at mortgage loans in 2025, comparing adjustable-rate and fixed-rate options, current rates, refinancing strategies, and what homebuyers should consider in today’s market.