Armenia’s expansion of the universal income declaration system, initiated in 2024, represents a bold attempt to enhance transparency and broaden the country’s tax base. By 2025, this system requires a wide array of citizens, from salaried employees to public servants and loan recipients, to file income declarations electronically through the Self-Portal system. While the initiative aligns with Armenia’s aspirations for fiscal accountability, the implementation process reveals critical shortcomings that could hinder its effectiveness and exacerbate existing inequalities.

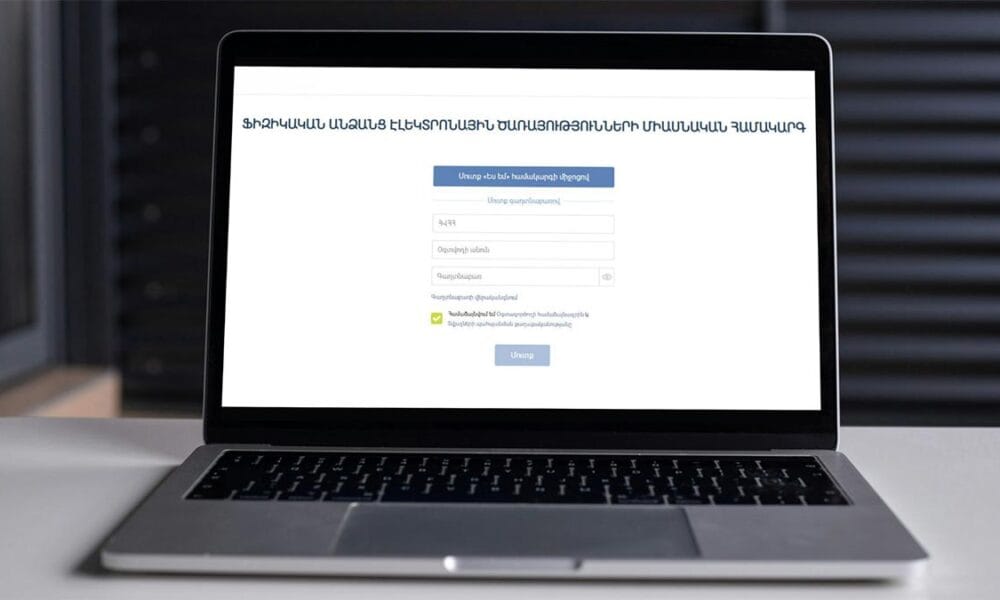

The reliance on digital tools as the primary means of filing declarations is a pivotal feature of the system but also a source of significant challenges. The requirement for strong electronic identification, such as ID cards and Mobile IDs, assumes universal access to technology and digital literacy. However, for citizens in rural areas, where internet connectivity and technological infrastructure are often limited, complying with these requirements becomes disproportionately burdensome. This raises concerns about equitable access to the system, as the very populations most likely to benefit from fiscal reforms may be excluded from participation due to logistical and technological barriers.

Additionally, the system’s administrative complexity poses challenges not only for taxpayers but also for the State Revenue Committee (SRC). With the expanded scope of declarations, the SRC faces the dual burden of managing a larger volume of filings while ensuring the system’s reliability and functionality. Without significant investments in digital infrastructure and human resources, delays in processing declarations and potential inaccuracies in tax assessments could erode public trust. These challenges are further compounded for first-time declarants, such as those receiving high-value loans or income through civil contracts, who may lack the financial literacy or familiarity with tax procedures required to navigate the system effectively.

Beyond accessibility and administrative hurdles, the reliance on digital platforms introduces systemic vulnerabilities. The success of the Self-Portal and Mobile ID systems hinges on their robustness and user-friendliness. Any technical failures, cyber threats, or disruptions in service could have far-reaching consequences, including missed deadlines, penalties, and diminished public confidence in the system’s reliability. For a system of this magnitude, even minor technical issues could disproportionately affect vulnerable groups, creating a cycle of mistrust and disengagement.

The economic implications of the universal income declaration system are equally complex. On one hand, it has the potential to increase state revenue by capturing untaxed income and expanding the tax base. Over time, these additional resources could be directed toward critical social programs, infrastructure development, and economic reforms. On the other hand, the system’s inherent complexity and perceived inequities could drive some economic activity further into the informal sector, particularly among small business owners or freelancers who view compliance as overly burdensome. This unintended consequence could undermine the system’s intended goals of transparency and equity, shifting the fiscal burden onto compliant taxpayers while allowing non-compliant actors to evade accountability.

To address these challenges, Armenia must take proactive measures to ensure the universal income declaration system achieves its full potential. Simplifying the declaration process for individuals with straightforward income structures would reduce the administrative burden on both taxpayers and the SRC. Targeted outreach programs to support rural and low-income populations, including financial assistance for obtaining ID cards and digital tools, would promote greater inclusivity. Strengthening the technical infrastructure of the Self-Portal and Mobile ID systems is equally crucial, as even minor disruptions could disproportionately affect vulnerable groups. Public awareness campaigns highlighting the benefits of compliance, such as eligibility for social tax deductions, would encourage voluntary participation while fostering a sense of trust in the system’s goals.

The broader implications of this system for Armenia’s citizens and economy hinge on its implementation. If executed effectively, the universal income declaration system could set a precedent for transparency, accountability, and fiscal equity, aligning Armenia with global standards of governance. However, if the challenges of accessibility, infrastructure, and public trust remain unaddressed, the system risks deepening existing inequalities and fostering resistance among those it aims to serve.

Armenia now faces a pivotal question: will the universal income declaration system serve as a catalyst for positive change, or will it perpetuate systemic disparities? The answer depends not only on the technical execution of the system but also on the government’s ability to prioritize fairness, inclusivity, and trust in its implementation.

References